sales tax rate in tulsa ok

Calendar Forms Lookup Meet the Assessor News Photo Gallery Save on Property Taxes. Oklahoma has one of the lowest median property tax rates in the United States with only six states collecting a lower median property tax than Oklahoma.

Oklahoma Sales Tax Small Business Guide Truic

If you sell tangible personal property in the state you must register for a sales tax permit if you have sales tax nexus.

. 20 plus 10 for each additional location. Grow Your Business 7x Faster. These buyers bid for an interest rate on the taxes owed and the right to collect.

Title 43-a - 1980 sales tax expenditure policy. Oklahomas median income is 52889 per year so the median yearly property tax paid by. Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65There are a total of 470 local tax jurisdictions across the state collecting an average local tax of 4264.

Zestimate Home Value. Denotes Use Tax is due for sales in this city or county from out-of-state at the same rate as shown. The Rent Zestimate for this home is 2134mo which has decreased by 16mo in.

Graphic design search engine optimization branding print media photography videography digital marketing coaching. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Tulsa OK at tax lien auctions or online distressed asset sales. City of tulsa sales tax code.

Tulsa code of ordinances. Rates Effective April through June 2022 Updated. We would like to show you a description here but the site wont allow us.

Click here for a larger sales tax map or here for a sales tax table. Reduce your working hours decrease costs and increase time freedom profits. It contains 4 bedrooms and 3 bathrooms.

Get Your Oklahoma Sales Tax Permit Online. Tulsa ok code of ordinances. Top Apply For Your Oklahoma Sales Tax Permit Now.

9704 S 100th East Ave Tulsa OK is a single family home that contains 2863 sq ft and was built in 1992. The latest sales tax rates for cities in Oklahoma OK state. Customers shop at Target at 21st and Yale Avenue in Tulsa Okla on August 82010 during the last day of the tax-free sales.

This is also in addition to the State Tax Rate of 45. Welcome to the webpage of Oklahoma County Assessor Larry Stein. August 2 2022 COPO LOCATION RATE CHANGE TAX TYPE TYPE OF CHANGE EFFECTIVE DATE.

That must be added to the city tax and the State Tax. Tulsa World File 2010 sales-tax-free weekend. Rates include state county and city taxes.

More than 25 million individual visitors searched the website this year for information about the nearly 330000 parcels in the 720 square miles that make up the county with a total market value of more than 73. The Zestimate for this house is 378500 which has increased by 15926 in the last 30 days. Repealing all ordinaces in conflict herewith.

Nc math 2 practice test. The overall sales tax rate in most of Oklahoma City is 8625 and 4125 cents of each dollar. The term nexus doesnt refer only to a companys physical presence although most businesses will have a physical connection in the state like inventory.

Since 2006 Clay Clark and his team have been offering a turn-key flat-rate one-stop-shop for all your business growth needs including. 2020 rates included for use while preparing your income tax deduction. Applying for an Oklahoma Sales Tax Permit is free and you will receive your permit 5 days after filing your application.

Every 3 years. Nexus as defined in tax terms is a business connection to a state. Oklahomas first sales-tax-free weekend brought shoppers from all over to Tulsa stores from Aug.

The median property tax in Oklahoma is 79600 per year074 of a propertys assesed fair market value as property tax per year. Combined with the state sales tax the highest sales tax rate in Oklahoma is 115 in. Tulsa OK currently has 830 tax liens available as of July 22.

While sales tax revenues reflect retail sales in Oklahoma City use tax revenues reflect online sales. 1063 maryport drive westfield. Tulsa revised ordinances to increase the monthly service charge rate by eight and one-half percent.

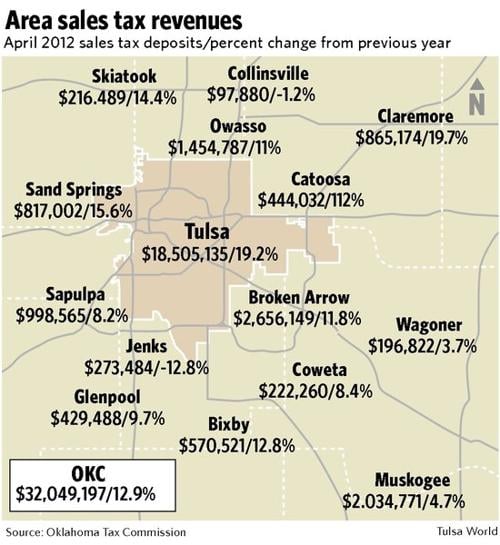

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

Sales And Use Tax Rate Locator

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax

Taxes Broken Arrow Ok Economic Development

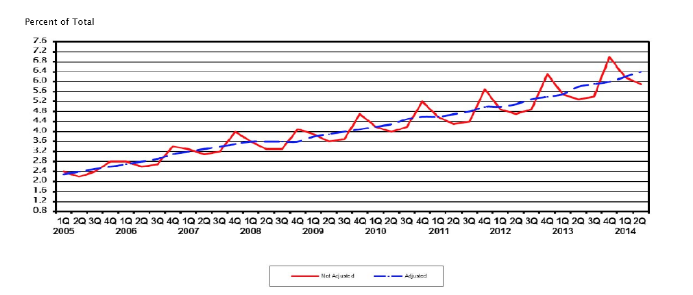

Individual Income Tax Oklahoma Policy Institute

Total Sales Tax Per Dollar By City Oklahoma Watch

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Oklahoma State Tax Ok Income Tax Calculator Community Tax

File Sales Tax By County Webp Wikimedia Commons

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

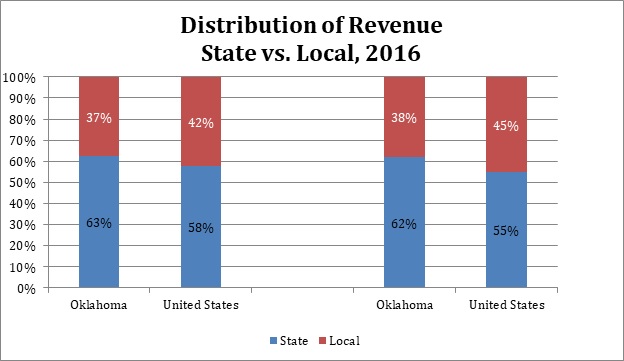

State And Local Tax Distribution Oklahoma Policy Institute

Use Tax For County Government Oklahoma State University

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

How Oklahoma Taxes Compare Oklahoma Policy Institute

Oklahoma Sales Tax Information Sales Tax Rates And Deadlines